The Icelandic central bank has a tricky problem. They have to make a long(ish) term predictions about inflation for the tiny island of Iceland. As Iceland makes almost nothing it consumes and most of what it makes is produced using resources from abroad The price level in Iceland is extremely sensitive to the depreciation of the Krona relative to its main partner currencies.

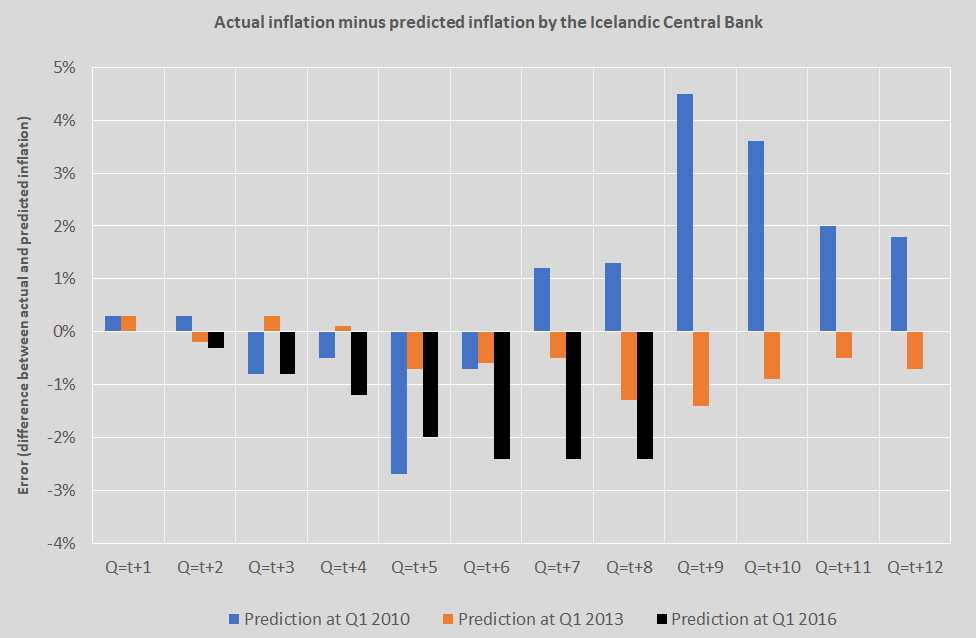

In the past, the Central Bank has done quite an alright job of predicting the inflation in the current and next quarter (which is less of a compliment than it sounds given that inflation in next quarter is usually quite close to what it is now). However, when it comes to anything beyond that they could probably just replace their model with Paul the Octopus. To illustrate this I collected data from three of their quarterly reports and compared their prediction with the actual outcome (see chart below).

In short, in this sample, on average the central bank under- or overestimated the future inflation (in each quarter) by:

- 0.4% in the same year as they made the prediction ;

- 1.5% in the year after they made the prediction; and

- 1.9% in two years after they made the prediction.

Now, with an inflation target of 2.5%, these are significant deviations, and when looking at their fan-chart it becomes quite clear that the Central Bank is a aware of their limitation to predict the inflation (see chart below). And in fact, they predict that inflation will be somewhere in the range of minus one and six.

On days like this I consider myself lucky to be only a micro-economist.

-Eiki

Leave a comment